straight life annuity with period certain

In most cases you can choose a. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder.

Guaranteeing benefit payments for a stated period of time after reaching age 65.

. A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. A straight life annuity is an. With this option you can enjoy the benefit of receiving a lifetime.

For example if you. The contract also guarantees that if T dies before receiving payments for 20. Funds in the annuity continue to earn this rate of return minus payouts.

Another option could be a period certain annuity. In spite of the payment option you select the benefits. The life annuity with period certain provides a life annuity with a guarantee for a certain period of time.

For example if you purchase a single-life. Five-Year Certain and Life Annuity means a monthly retirement benefit payable to the Participant for life and if the Participant dies before receiving 60 monthly. There are basically two ways to purchase a straight life annuity policy.

A life annuity with period certain is a hybrid option that provides lifetime payments with guaranteed income for a specified number of years. This differs from a pure life annuity where. Making periodic payments into the annuity over the course of the annuitants working life.

A life annuity with period certain is characterized as. Straight life annuities are most commonly purchased between the ages of 45 and 55 by individuals who are not yet retired. Period certain is a life annuity option that allows the customer to choose when and how long to receive payments which beneficiaries can later receive.

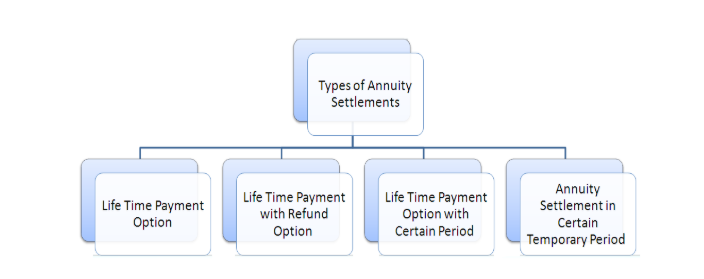

When you are ready to retire a life annuity with period certain is one of many payout options offered by insurance companies. Straight life annuities do not include a. While a straight life annuity is tied to your lifespan period certain annuities pay out over a set amount of time regardless of.

A life annuity with period certain is a type of life annuity that allows you to choose when and how long to receive payments. Guaranteeing a minimum interest rate. The life annuity with period certain provides a life annuity with a guarantee for a certain period of time.

A 10-Year Certain And Life Annuity is a type of annuity that will provide payments to you for the rest of an annuitants lifetime with a minimum of 10 years even if you die. A life annuity with period certain annuity is a contract that guarantees payments for an annuitants entire life along with a guaranteed period. A life annuity with a period certain annuity is a contract that guarantees payments for an annuitants entire life along with a guaranteed period of time typically 5 to 20 years.

If you pass away. A straight life annuity is an annuity that pays a guaranteed stream of income but ceases payments upon the death of the annuity holder. Life Annuity with Period Certain T has an annuity that guarantees an income payment for the rest of his life.

With this option you choose a specific period of time during.

Life Income Joint And Survivor Settlement Option Guarantees Quickquote

Life Insurance Annuity Products In New York Department Of Financial Services

:max_bytes(150000):strip_icc()/Term-a-annuity_Final-22818c662b274f2c82716dd2184f06c9.png)

Guide To Annuities What They Are Types And How They Work

Annuities What Is An Annuity Financial Pipeline

The Pros And Cons Of Joint Life Annuities Trusted Choice

Do You Get Your Principal Back From An Annuity It Depends Approach Financial

Annuity Payout Options What Does Period Certain Mean And How Can It Help You Safemoney Com

What Is A Straight Life Annuity Everything You Need To Know

Annuity Payout Options Payment Types Retireguide Com

Life Insurance Vs Annuities Which Is Best For You

You Re Getting A Pension What Are Your Payment Options Beyond The Numbers U S Bureau Of Labor Statistics

/stacks-of-coins--a-compass-and-documents-signaling-finances-184104157-eea22b5b70b744318f04c2b6f54a5ef4.jpg)

Straight Life Annuity Definition

Computing Annuity Factors For Pension Funds Endowment Insurances And Provident Funds By Roi Polanitzer Medium