does wyoming have sales tax on cars

Does Wyoming charge sales tax on vehicles. 2022 Wyoming state sales tax.

Petersen Automotive Museum Los Angeles Museum Petersen Rolls Royce Car Museum Automotive

The state of Wyoming does not usually collect sales taxes on the vast majority of services performed.

. The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. No entity tax for corporations. The Excise Division is comprised of two functional sections.

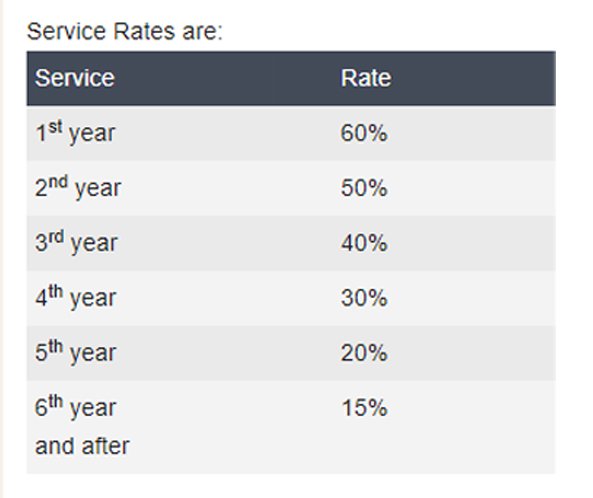

The year of service rate is calculated like the following. Does wyoming have sales tax on cars. 4 percent state sales tax one of the lowest in the United States.

Classic cars have a rolling tax exemption. Are services subject to sales tax in Wyoming. Factory cost X years of service rate X 003 county fee.

In addition Local and optional taxes can be assessed. Deduct 40 20 x 200 on schedule a the personal use portion of the fee that is based on the vehicles value. Does wyoming have sales tax on cars Friday March 4 2022 Edit.

The rate is also determined by the local municipalities so it varies from one area to another according to the state. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles. Wyoming Use Tax and You.

An example of taxed services would be. No personal income taxes. The county treasurer collects a sales or.

Currently combined sales tax rates in wyoming range from 4 to 6 depending on the location of the sale. What States Have No Sales Tax on RVs. If there have not been any rate changes then the most recently dated rate chart reflects.

To avoid the fine pay this tax within 60 days of purchasing your vehicle. Does Wyoming Have Sales Tax On Food. If you dont pay it within 60 days youll be penalized the.

The current rate for Niobrara County is 6. 30000 X 50 X 003 450. However some areas can have a higher rate.

If you dont pay within 60 days youll be slapped with a 25 fine. How To Calculate Sales Tax And Vehicle. Wyoming collects a 4 state sales tax rate on the purchase of all vehicles.

Rates include state county and city taxes. Exact tax amount may vary for different items. For vehicles that are being rented or leased see see taxation of leases and rentals.

Does Wyoming Have Sales Tax On Cars. However some areas can have a higher rate depending on the local county tax of the area the vehicle is purchased in. For example if you live in Louisiana which.

There are currently five states that have no sales tax at all Alaska Delaware Montana New Hampshire and Oregon. Some of the advantages to Wyomings tax laws include. 2020 rates included for use while preparing your income.

We have almost everything on ebay. Restaurants In Matthews Nc That Deliver. Opry Mills Breakfast Restaurants.

Below is a list that shows which states require insurance companies to pay sales tax above and beyond the vehicles actual cash value. The median property tax in Wyoming is 105800 per year for a home worth the median value of 18400000. Tax rate charts are only updated as changes in rates occur.

However the state has an effective vehicle tax rate of 26. State wide sales tax is 4. Mclaren P1 Takes The Stage To Show Off It S Beautiful Design Video Super Cars Mclaren P1 Normal Cars.

This way you dont have to pay a sales tax on your car in the new state when you re-register it. The latest sales tax rates for cities starting with A in Wyoming WY state. For sales and use tax rates for all Wyoming counties visit the Wyoming Department of Revenues website at httpsrevenuestatewyus.

The Wyoming state sales tax rate is 4 and the average WY sales tax after local surtaxes is 547. There are some other loopholes too. Up to 25 cash back When you buy an expensive item of personal property like a top-grade motorhome or RV the sales tax can be enormous.

Counties in Wyoming collect an average of 058 of a propertys assesed fair. Therefore if a vehicle with a factory cost of 30000 registered in its 2nd year the calculation would be. Sales Use Tax Rate Charts Please note.

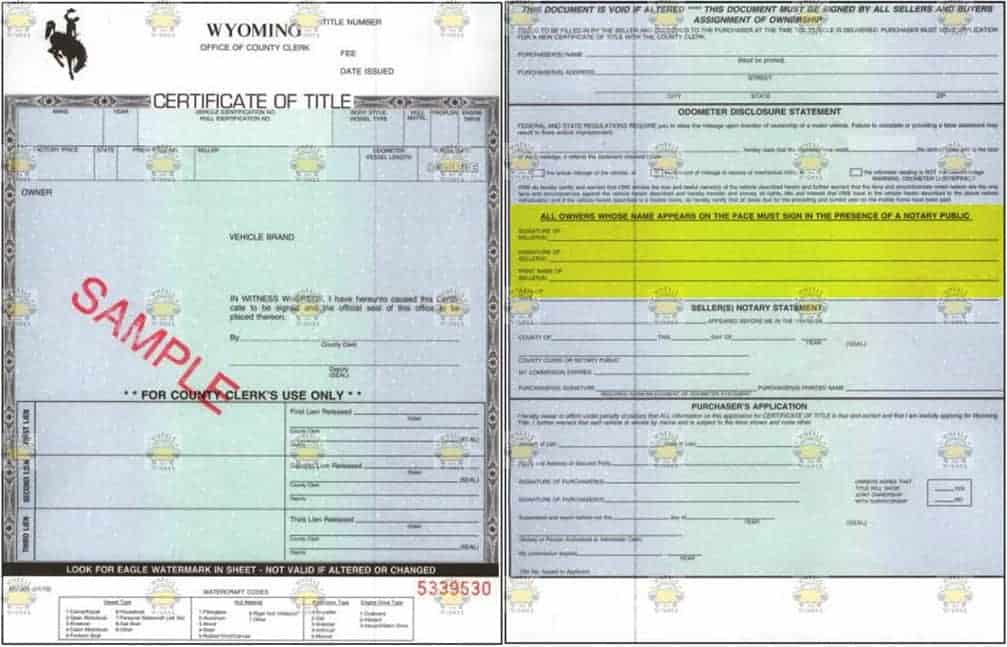

Wyoming Vehicle Donation Title Questions

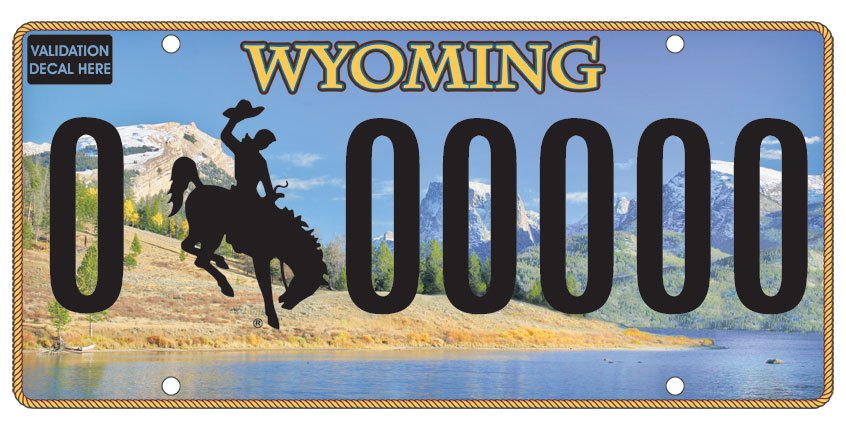

If You Re Shopping For A Used Car Make Sure You Buy It In Wyoming

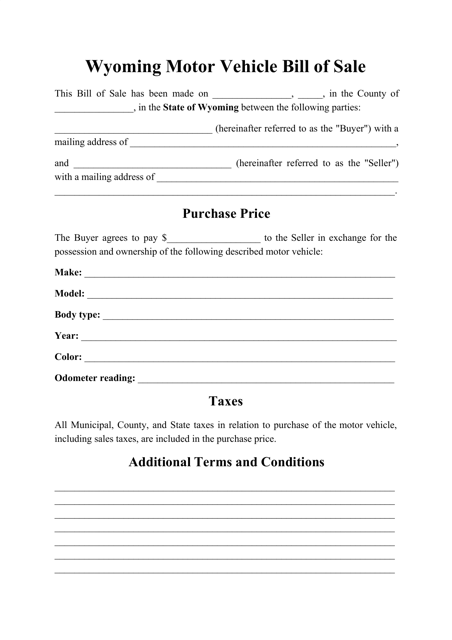

Wyoming Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Car Sales Tax In Wyoming Getjerry Com

Nj Car Sales Tax Everything You Need To Know

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming

Fillable Form Wyoming Vehicle Registration Mv 300a Wyoming Registration Fillable Forms

Sales Tax On Cars And Vehicles In Wyoming

1976 Hornet Sportabout Wagon Amc Page 2 Usa Original Magazine Advertisement American Motors Amc Protection Plans

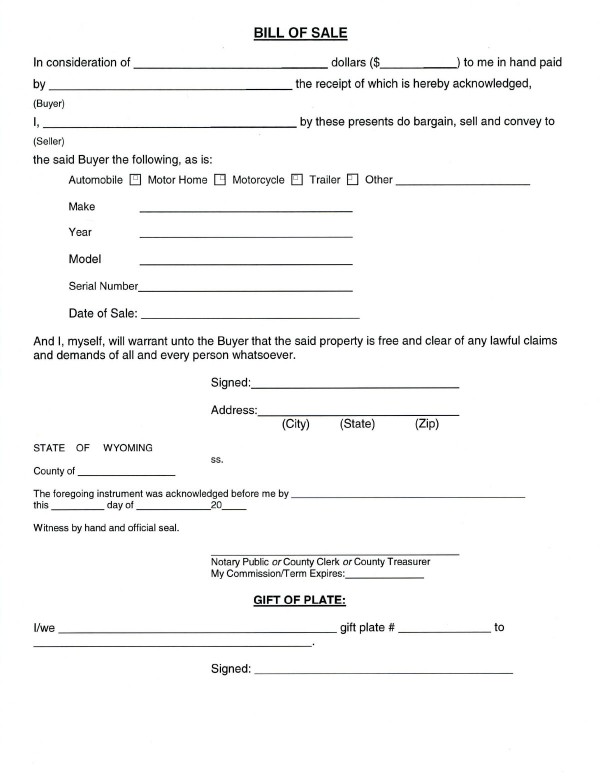

Bills Of Sale Forms In Wyoming Facts Requirements In 2020

What S The Car Sales Tax In Each State Find The Best Car Price

Pin By Annette Waller On Wyoming Proud Old Gas Stations Wyoming Carbon County

Bronco Road Trip Pacific Coast Highway Classic Bronco Classic Ford Broncos Ford Bronco

Car Sales Tax In Wyoming Getjerry Com

If You Re Shopping For A Used Car Make Sure You Buy It In Wyoming

How To Calculate Sales Tax And Vehicle Registration Fees In Wyoming